Digital Transformation

We did optical character recognition (OCR) to extract information from scanned invoices using Artificial Intelligence (AI)

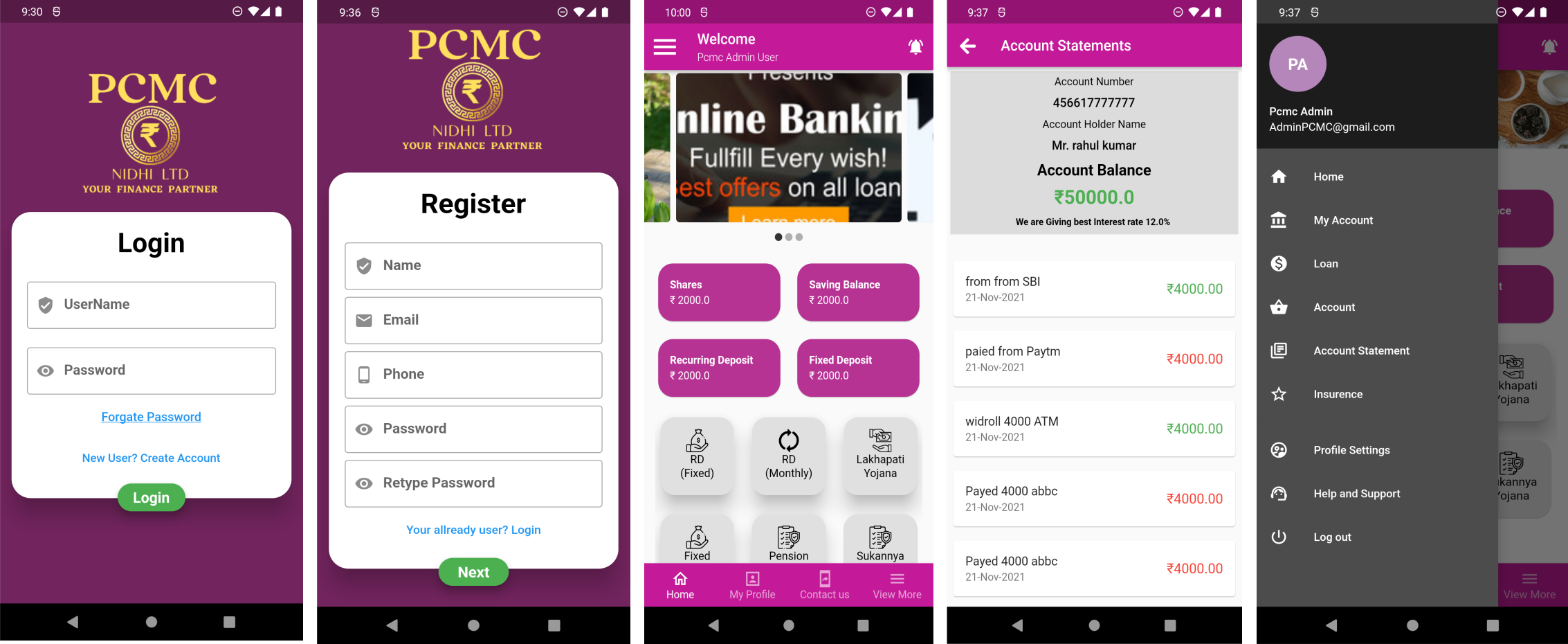

Private financial institute involved in creating awareness about savings by offering products to save money in a systematic and secure manner.

The client was a traditional bank, where all customer accounts and data were being primarily stored in physical form which involved a lot of manual work. From the account opening to buying a product like fixed deposit/recurring deposit, customer’s physical presence was necessary. Thus it was a very hectic and time-consuming process for both employees and customers.

Opening a new account was time-consuming, involving a verification process with manual KYC and physical forms.

For any bank transaction - balance inquiry, interest accrued, or check transactions, the customer had to visit the financial institute in person.

It was difficult to add multiple schemes manually for one user. (Schemes like Mahabachat Monthly Deposit Scheme, Monthly Deposit / Recurring Deposits Scheme etc.)

Sharing notifications with account holders regarding transactions, balance etc. was challenging.

Maintaining and merging old database features with new database features was difficult on the old systems.

Safety and security of records was an issue as they were not saved in proper databases.

At Digital Flake, using our expertise in application development, we provided the client with a digital transformation solution. This will transform the client’s traditional working process into a digital working environment.

We developed an online system for account application, where users can fill forms, upload required verification documents, and read and understand terms and conditions.

We developed an android app and a website where users can check all their account details like transactions, fixed deposit details, available balance etc.

For secure login authentication & authorisation, there is a two-factor authentication feature built in the application.

We created a notifications page where the financial institute’s notifications are visible to all account holder customers.

The application has options for users to add multiple schemes for single account holder-customers.

We built a single system to manage all accounts and check each account-holder detail.

Application created using Flutter

Application can be downloaded for android and iOS platforms.

Backend API is written using the Node.js environment.

The data is stored in a MySQL Database.

For Exchange (Authentication) security, the app uses JWT tokens.

Two-factor authentication, with password and Mobile OTP. Session time out feature if the user is idle, for security reasons.

For new customers, account opening is quick and simple.

Existing account holders have improved customer experience as they are able to access all account related information on the mobile app.

Data capture happens without human intervention allowing for better employee performance and level of satisfaction.

Automation with proper authentication ensures fewer fraudulent activities.

DigitalFlake is a digital transformation company founded by engineers to help businesses benefit from emerging technologies. The company has worked with startups and established firms across various verticals, helping them build enterprise-scale apps to drive operational efficiency and meet business objectives

We did optical character recognition (OCR) to extract information from scanned invoices using Artificial Intelligence (AI)

We did optical character recognition (OCR) to extract information from scanned invoices using Artificial Intelligence (AI)

Two wheeler servicing company needed help building an expense management system to organise vendors, vouchers and invoices in a customised solution.

Client faced problems tracking old and new customer calls. We provided an automated solution for tracking and mapping outgoing calls and incoming leads

Copyright © 2021 | Powered by Digitalflake